We live in the age of feedback.

Customer experience - a market centered around customer feedback - is one of the fastest growing industries. It’s on track to be a $17 billion industry by 2022 (Source: marketsandmarkets.com).

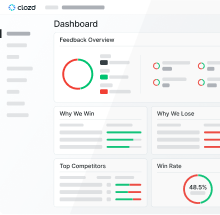

Just as businesses have recognized the benefits of understanding the customer experience, there is also huge upside in understanding the buyer experience. Win-loss analysis is tailored to do just that - helping organizations better understand, in detail, the experience of the buyer during the evaluation process. The core of win-loss analysis is coming to understand why buyers make the decisions they make - a simple concept with huge potential returns.

But, what is the best strategy for capturing the buyer’s experience and understanding their decision making process? Speaking with them directly.

And while most organizations intuitively understand the value of win-loss analysis, execution of an effective win-loss program can often seem daunting and difficult. Clozd frequently speaks with organizations that are unable to capitalize on buyer feedback due to several common roadblocks. Let’s explore these common win-loss roadblocks and learn the best strategies for avoiding and overcoming them.

Already doing win-loss analysis?

Take this short assessment to see how your approach stacks up against best-in-class programs.

Roadblock #1: Where to start?

The first roadblock to overcome is deciding where and how to start. Organizations that are new to win-loss analysis face many daunting and time-consuming questions. What is the right method of data collection? Qualitative or quantitative? How do we get our buyers to participate? What questions should we ask? How do we track themes and trends across buyers? Should we reward them for participating? Should we record each interaction with our buyers? What technology should we use? What is the best way to translate the feedback into meaningful action?

Best practices show us how to overcome this roadblock. Start by keeping it simple and utilizing an expert. Make a small investment in hiring an experienced third-party and go from there. An experienced partner will provide thought leadership, free up bandwidth, employe proper research methodology, and harvest more candid/open feedback from your buyers. Let them do the heavy lifting, so you can focus on improving your business.

Roadblock #2: Inadequate resources, budget, or bandwidth.

It’s easy to make the ROI case for win-loss analysis. Knowing why you win and lose will, without a doubt, enable you to take corrective action and start winning more. Unfortunately, the strongest advocates for win-loss analysis within an organization are often those that lack the budget, bandwidth, or resources to implement an effective program.

The solution is simple . . . secure executive sponsorship. Few executives will fail to see the value proposition of an effective win-loss initiative. If you need help, check out our previous blog post on estimating the ROI of your investment in win-loss analysis. Accordingly, reputable firms like Gartner have found that rigorous win-loss analysis can increase win rates by as much as 50%.

Kicking off a win-loss program doesn’t always require a large initial investment of time or money. For example, offload the work to an experienced third-party who can help you focus on a small segment or pocket of your business. Then build off of that momentum to broaden the program over time.

Ultimately, the real question to ask is can you really afford to not get buyer feedback? Once you realize the benefits, it’s easy (and worth it) to make the investment.

Roadblock #3: Poor coordination and resource allocation.

In many organizations, win-loss analysis is a fragmented effort. One team may have made an attempt at win-loss analysis without coordinating or disclosing their efforts to other functions or teams. In many cases, the analysis is based on internal data, like CRM data or discussions with sales reps.

In a typical organization, there are multiple teams that have a vested interest in win-loss analysis and may be making some sort of attempt at the practice . . . product management, sales, product marketing, sales enablement, strategy, etc. Thus, the interest and resources to invest adequately in win-loss analysis are there, they’re just spread poorly across the org. Coordinating these efforts can go a long way and usually leads to success.

To illustrate this point, here’s a scenario that that took place for one of Clozd’s clients, prior to working with us. The client understood the need for direct feedback via interviews with decision makers - this resulted in four product managers spending 10-20% of their time attempting to execute the win-loss program. As mentioned prior, this included gathering and compiling names from sales and other organizations, scheduling, interviewing, transcribing, synthesizing, and sharing the feedback they gathered.

Assuming those product managers each earned compensation of roughly $150,000 per year, then roughly $15,000-$30,000 of their yearly salary was dedicated to performing win-loss interviews and analysis. Collectively, they were devoting $60,000 or $120,000 of their bandwidth to the project. Once more functions were engaged, including the leadership team, it became apparent that the product managers needed additional support. Leadership saw that partnering with Clozd would free up the time for these product managers to focus on their core job responsibilities. The freed bandwidth of the product team would more than pay for Clozd’s services. Plus, the expertise of Clozd would result in higher quality interviews, better interview scheduling rates, and stronger cross-functional adoption of the feedback thanks to Clozd’s unique software platform.

Roadblock #4: We already know why we win and lose.

In some cases individuals, or organizations collectively, believe that they already have a sufficient understanding of why they win and lose. When presented with the concept of buyer feedback, they reply “we already talk to our buyers and know why we win and lose.”

Surprisingly, as we dig deeper, we often find that these particular companies are actually the worst at talking with their buyers. They don’t track win rates and they base their understanding of why they win or lose on the anecdotes they hear from the sales team.

This cultural arrogance is dangerous. One study found that sales reps, on average, were wrong about why their deals were won and lost about 60% of the time (Source: Blog Post). Companies with this demeanor are vulnerable to hungry, up-and-coming disruptors that are more tuned into the buyer experience. Basing major strategic decisions on a biased, internal perspective of why deals are won and lost is a dangerous approach.

This overconfidence is often coupled with self-protection. Buyer feedback can be hard to hear. As a sales leader, it’s difficult to hear that your sales team can be a challenge to work with. That kind of feedback reflects poorly on you. When a product leader hears that their product is confusing and difficult to use, that can be hard to stomach. These situations could even lead you to question your job security. But, at the end of the day, it should be your job to fix what’s wrong. You accomplish that by understanding your buyers and addressing the real drivers behind your wins and losses.

In summary

- Overcome Roadblock #1 by starting small and investing in third-party win-loss services.

- Overcome Roadblock #2 by making an ROI case to secure executive sponsorship.

- Overcome Roadblock #3 by coordinating cross-functionally.

- Overcome Roadblock #4 by fostering a culture that values feedback.

Curious if a partnership with Clozd is right for your organization? We’d love to chat and answer your questions.

.svg)

.svg)

.svg)