There is a critical point in developing any win-loss program where the program administrator must take the data collected from the program and interpret that data to yield actionable insights. If done well, this phase of the win-loss process results in a cohesive narrative that allows decision-makers to understand better why the company wins and loses. More importantly, a clear diagnosis of win and loss reasons elevates the program from merely providing interesting information to driving action that propels the organization to win more deals.

To take your program from data collection to insight, we recommend following three steps that will enable you to uncover your organization’s true win-loss story. Note that we will use the example of win-loss interviews, but a very similar process would apply to other feedback channels, like buyer surveys or surveys from sales representatives.

Step 1 - Identify decision drivers and assign sentiment.

After each interview, the interviewer should critically look at the primary reasons the deal was won or lost. It is useful to organize these reasons into decision drivers and decision driver categories.

Examples of decision driver categories could be broad topics such as Pricing, Product, Sales, or Support & Service. Within those categories, individual decision drivers can be assigned. Examples of decision drivers within the broader Product category may include User Interface and User Experience, APIs & Integrations, and Customizability & Flexibility, among others.

Once you have determined the key decision drivers that most influenced the deal outcome, you can then assign sentiment: positive sentiment for drivers that increased the likelihood of a win, and negative sentiment for drivers that increased the probability of a loss.

We typically find that with each deal, there are 3-5 primary decision drivers that influence the outcome, and sometimes more for complex sales situations.

Step 2 - Observe trends in the data.

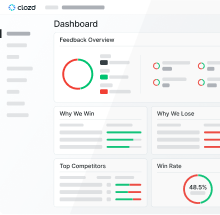

After you have assigned drivers to each interview, the insights from the interviews start to take shape. By summing the number of positive and negative mentions for each driver, you can see broader trends that speak to the overall reasons deals are won or lost.

There are several different ways you can try to summarize or visualize this data.

At a high level, we recommend looking at the drivers with the most positive mentions for wins as the best explanation for why you win. Conversely, the drivers with the most negative mentions for losses are the best explanation for why you lose.

Step 3 - Use other available data to provide context to your findings.

Knowing why you win and lose deals is the core goal of any win-loss program. However, if you can pair and cross-tabulate your win-loss insights with other available data, the findings can be even more powerful.

For example, you might juxtapose your key decision drivers for European deals against your key decision drivers for deals in North America. You might want to see if smaller deals are won and lost for the same reason as larger deals.

These methods of segmenting your data can bring more specificity to your program and make the insights even more actionable.

Recently, with one of the programs I was running, we employed this process to try to identify ways the sales organization could improve at a publicly traded US-based SaaS company.

The company wanted to determine why they were losing deals in the later stages of the sales cycle. To do this, we only looked at deals where the CRM indicated the deal was lost in one of the final two sales stages.

After conducting several interviews with prospective customers who decided not to make a purchase, we found one of our most prominent negative decision drivers was Value: Timing, Urgency, or Need. This driver is often used when the main reason the deal was won or lost was based on the buyer’s urgency to purchase the product or service.

The prevalence of this theme begged the question: Why are so many buyers deciding not to purchase because they determine they don’t have an urgent need for a product like this?

After reading through the interviews and thinking about this main decision driver in the context of the fact that we only interviewed later-stage deals, we decided to include the following statement as one of the main takeaways from that batch of interviews, Lack of value perception on late-stage deals may indicate a sales qualification issue.

It was clear to us that if the salespeople from this SaaS company did a better job asking the right questions at the beginning of the sales process, they would have a much better chance of identifying if the buyer was actually serious, thus wasting much less time in follow up conversations with buyers who were not serious and redirecting their efforts to those genuinely interested in a purchase.

This is just one small example of how we took win-loss interview data, assigned decision drivers, and thought critically about those decision drivers in the context of the other data we had at our disposal.

Jonathan is a consulting team lead at Clozd who manages client programs and mentors/leads other Clozd consultants. During his tenure at Clozd, Jonathan has managed win-loss programs for notable clients such as ADP, SAP, and Adobe, conducting more than 1,300 win-loss interviews since the start of 2019.

Before Clozd, Jonathan worked as a management consultant for Cicero Group, a top 40 management consulting firm specializing in market research. In this role, he was promoted to engagement manager, served as interim VP of Operations for a client (with over 40 reports), and carried out complex research projects including conjoint analysis, segmentation analysis, and in-depth qualitative studies. He also has experience in financial services as an investment banking analyst for Wells Fargo Securities.

Jonathan holds an MBA from the University of Chicago Booth School of Business and a double-major in Economics & Mathematics from Brigham Young University.

.svg)

.jpg)

.png)

.svg)

.svg)